Understanding Credit Reporting in Canada: A Comprehensive Guide

In Canada, like in many other countries, credit reporting plays a significant role in financial transactions. Whether you’re applying for a loan, a credit card, or even renting an apartment, your credit report can influence the outcome. Understanding how credit reporting works in Canada is essential for managing your finances effectively. This comprehensive guide aims to shed light on the intricacies of the Canadian credit reporting system.

What is Credit Reporting?

Credit reporting is the process of collecting and maintaining information about an individual’s credit history. This information is then used by lenders, landlords, and other entities to assess an individual’s creditworthiness. In Canada, credit reporting is primarily managed by credit bureaus, which are private companies that collect and distribute credit information to authorized parties.

Key Players in Canadian Credit Reporting:

Equifax Canada: Equifax is one of the major credit bureaus operating in Canada. It gathers information from various sources, including lenders and financial institutions, to compile credit reports for individuals.

TransUnion Canada: TransUnion is another prominent credit bureau in Canada. It collects similar information to Equifax and provides credit reports to businesses and consumers upon request.

What Information is Included in a Credit Report?

A Canadian credit report typically includes the following information:

Personal Information: Name, address, social insurance number, and date of birth.

Credit Accounts: Details of credit cards, loans, mortgages, and other credit accounts, including account balances, credit limits, payment history, and account status.

Inquiries: Records of inquiries made by lenders or other parties regarding your credit history.

Public Records: Information regarding bankruptcies, liens, and judgments.

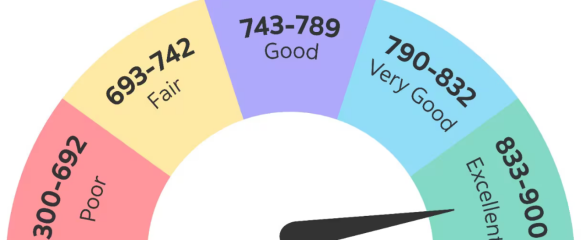

How is Credit Score Calculated?

In Canada, credit scores are generated based on the information contained in your credit report. The most commonly used credit scoring model in Canada is the FICO® Score, developed by the Fair Isaac Corporation. The FICO® Score ranges from 300 to 900, with a higher score indicating better creditworthiness.

Key factors influencing your credit score include:

Payment History: Timely payments on credit accounts contribute positively to your score.

Credit Utilization: The amount of credit you’re using compared to your total available credit.

Length of Credit History: The age of your credit accounts.

Types of Credit: The mix of credit accounts you have, such as credit cards, loans, and mortgages.

New Credit: Recent credit inquiries and newly opened accounts.

Importance of Credit Reporting:

Maintaining a positive credit history is crucial for various financial activities, including:

Access to Credit: A good credit history makes it easier to qualify for loans, credit cards, and other forms of credit at favorable terms and interest rates.

Renting an Apartment: Landlords often check credit reports to assess the risk of potential tenants. A positive credit history can increase your chances of securing a rental property.

Employment Opportunities: Some employers may review credit reports as part of the hiring process, particularly for positions involving financial responsibility.

Your Rights as a Consumer:

As a consumer, you have rights concerning your credit report under the Canadian federal law, including:

The right to request a free copy of your credit report from each credit bureau once a year.

The right to dispute inaccuracies or incomplete information on your credit report.

The right to be informed if your credit report is used against you, such as in a loan denial.

Tips for Managing Your Credit:

To maintain a healthy credit profile in Canada, consider the following tips:

Pay your bills on time to avoid negative marks on your credit report.

Keep your credit card balances low relative to your credit limits.

Regularly review your credit report for errors and dispute any inaccuracies.

Limit the number of credit applications you make, as multiple inquiries can temporarily lower your credit score.

Use credit responsibly and avoid excessive debt.

Conclusion:

Credit reporting is a vital aspect of the Canadian financial system, influencing access to credit, housing, and even employment opportunities. By understanding how credit reporting works and managing your credit responsibly, you can build and maintain a positive credit history. Stay informed, monitor your credit regularly, and take proactive steps to protect and improve your creditworthiness in Canada.